Digital banking in the country recorded impressive growth in the past few months as customers opted to use alternative and cashless channels, adopting preventive measures against COVID-19.

The pandemic has pushed the masses to switch to contactless, free of cost, hassle-free modes for personal and commercial purposes.

Not only did numerous customers use digital banking for the first time but those who were familiar with the banking mode have enhanced their usage in the past few days in order to avoid visiting branches or using cash in financial dealings.

According to one of the leading banks, Habib Bank Limited, it recorded a staggering 61 percent growth in customers registering for internet banking whereas it also recorded 41 percent growth in customers using mobile banking.

The use of phone banking grew by 37 percent and 60,000 new accounts were accounts opened through HBL Konnect, it added.

According to an HBL spokesman,

The outbreak of COVID-19 and its related lockdown created an environment that acted as a catalyst for people to relook their behaviors, viz-a-viz their information needs and transaction needs. We looked at a period where the COVID-19 lockdown was enforced and compared it to a recent period where all branches were operational, which showed that people gravitated significantly towards digital banking channels.

HBL has registered over 1.15 million users for mobile and internet banking services by the end of 2019.

A couple of months ago, State Bank of Pakistan (SBP) directed banks to withdraw charges on digital banking services on the account of fund transfer, bill payment, mobile top-up and etc.

Shariq Mubeen, Head Alternate Distribution Channels at Meezan Bank Limited said:

Mobile Banking usage for financial transactions including funds transfer and bill payments has increased by over 45% on a week to week basis after the announcement of lockdown. I see this as a positive sign in digitizing our services as it brings more convenience to our customers.

The central bank also lifted the condition of biometric verification of customers on a temporary basis. The decision was taken as a part of preventive measures to reduce the visit of customers to branches whereas the use of currency notes should be restricted which can spread COVID-19.

Withdrawal of this condition has significantly supported the rapid growth of digital transactions which was seen immediately after lockdown, Shariq added. Almost 20-30% of customers were not able to go beyond this point after downloading the app due to this verification step in the past but the userbase on digital channels has grown significantly due to the lockdown and the availability of free of cost banking service through different alternate banking channels.

“From here onwards, we believe that this growth pattern will continue as we transition to the new normal post-COVID-19,” the official at Meezan Bank remarked.

While banks continue to promote their digital services, a UK-based bank got an opportunity to introduce virtual accounts for big corporations to maintain their earnings during the lockdown.

Standard Chartered Pakistan has come up with virtual accounts for Pakistan International Container Terminal (PICT) that enabled the company to reach out to their large customer base during the lockdown.

Virtual accounts, as the name implies, are not actual accounts opened in Standard Chartered’s books, but represent a system of identifying the client’s customer, via a unique consumer reference number. Each of the client’s customers is assigned a virtual account number to identify individual payers and facilitate reconciliation.

The outgoing CEO Standard Chartered Pakistan, Shazad Dada, said,

We are the first in the industry to co-create a digital solution for PICT given the difficulties experienced by their clients. Technology is core to the bank’s digital strategy to delivering the next generation of best-in-class products to cater to our clients’ evolving needs.

Banking has been digitized at an accelerated pace worldwide and in Pakistan during the lockdown. Local banks should not only facilitate customer onboarding for digital modes of banking but also introduce innovative ways of banking and transactions in the easiest ways with safety and protection.

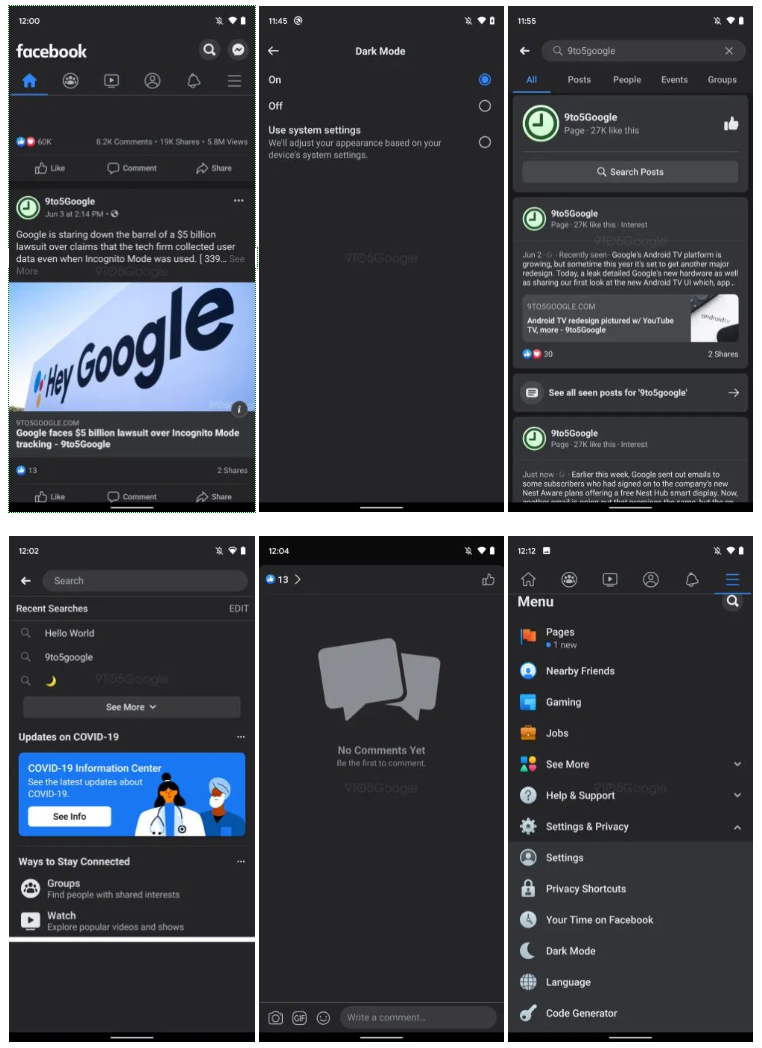

Banks should promote digital banking services through available marketing channels and raise awareness through tutorials and social media.

The post Digital Banking Services in Pakistan Record Impressive Growth During Lockdown appeared first on .