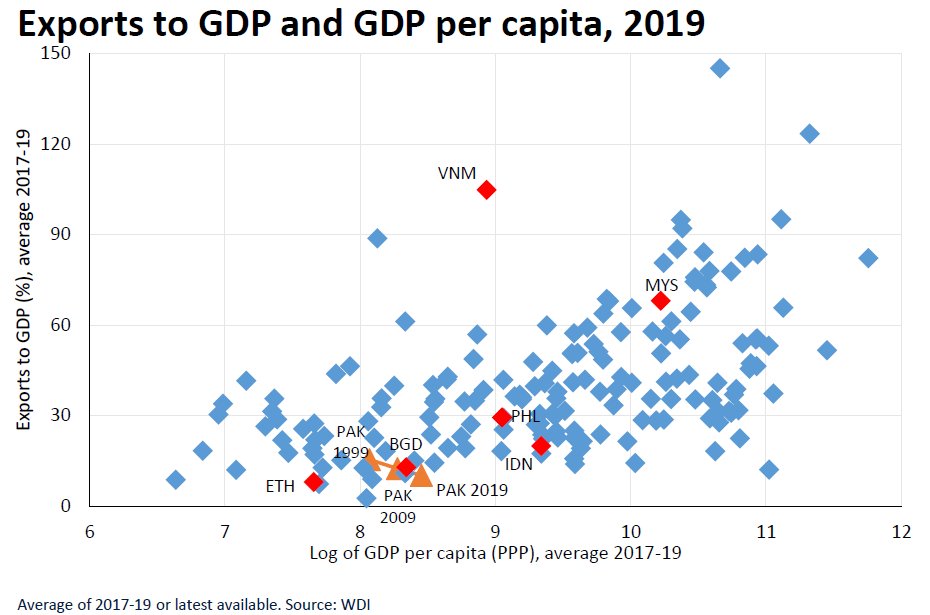

Since the turn of the century, Pakistan has become a more inward-oriented economy with exports to GDP ratio falling from 16 percent to 10 percent, macro-economist and policy researcher Gonzalo Varela tweeted on Monday, quoting World Development Indicators (WDI) data.

Wanted to analyze #Pakistan's #export performance, benchmarking with structural and aspirational countries, along 4 dimensions – #growth, #diversification, #quality, #survival. Thread below: ???

— Gonzalo Varela (stay safe) (@gonwei) November 16, 2020

In a series of tweets, he analyzed Pakistan’s export performance, benchmarking it with other comparable economies along the vertices of growth, diversification, quality, and survival.

In this article, ProPakistani will simplify and elaborate on the data and findings presented by Varela for those unfamiliar with economic terminologies and complexities, and try to add insight into both the industry parameters and Gonzalo’s data points.

ALSO READ

FDI Witnesses a Massive 150% YoY Increase in October

Jotting down the details, Varela said that as a result of this falling exports to GDP ratio, Pakistan’s share of the world markets fell from $16 per $1,000 in trade in 1990 to only $12 out of every $1,000 traded in 2019.

Comparing it to other “structural and aspirational countries”, he also noted that Bangladesh’s share in world trade increased from $5 to $18 per $1000 traded during the same time period, while Vietnam’s jumped from $14 to $113. Philippines, Indonesia, and Malaysia also showed an increased share on average during the same time period.

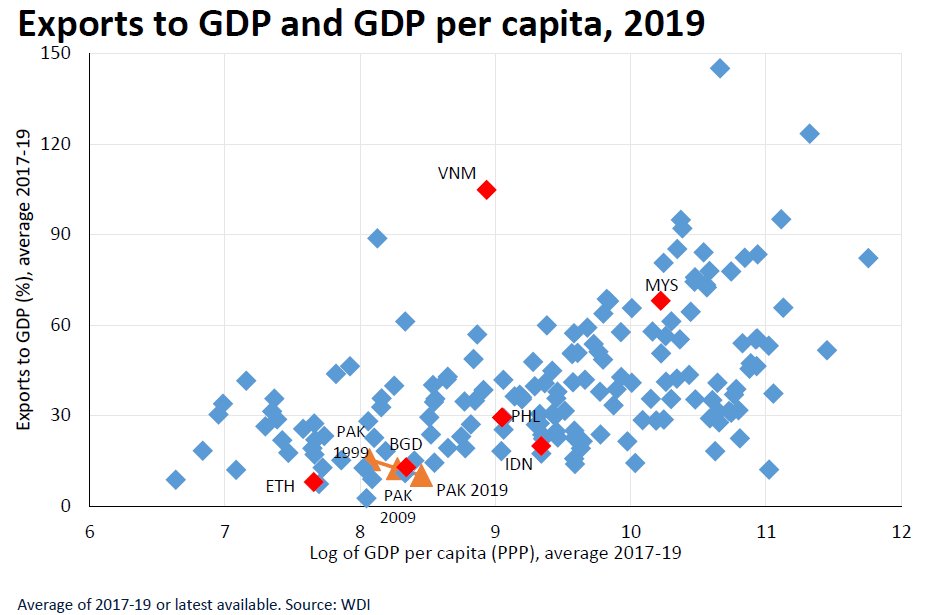

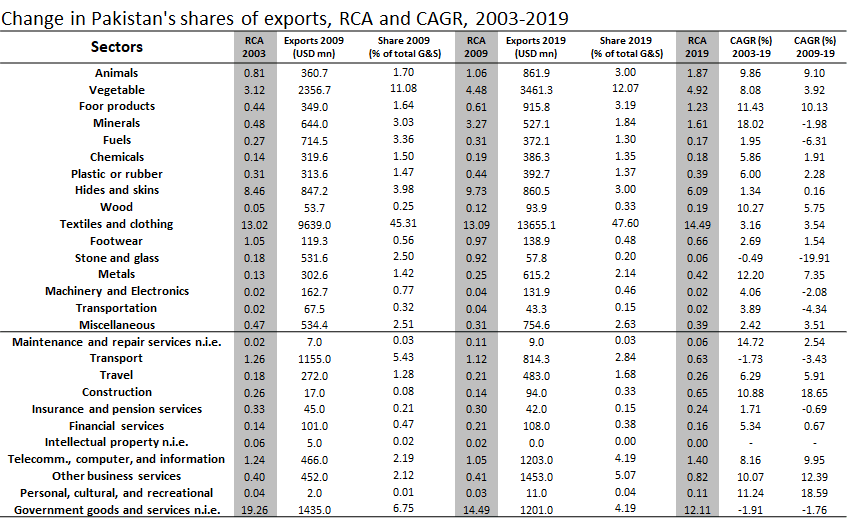

Despite this overall contraction in Pakistan’s share of international trade, certain sectors of the economy continued their individual growth. Varela highlighted “food products, animal, vegetables and IT and IT-enabled services” to name a few, and wrote, “They gained market shares and built a comparative advantage. Textiles and Apparel have been losing out”.

“But even within textile and apparel, some subsectors are doing better than others,” he said. Pakistan’s Apparel has been gaining market share (above the red line), even though textiles and cotton altogether have been losing market shares in the last decade.

According to the data that Varela shared, the other sectors – albeit less economically relevant in terms of international trade factors – that stood out for their contribution changes are “stone and glass products” that lost approximately 19 percent share, and “personal, cultural, and recreational services” that gained about 19 percent of the trade share during the same time period.

The macro-economist highlighted ‘diversification’ as another challenge faced by Pakistan’s export sector. He said that Pakistan’s exporters have been reaching fewer destinations – 197 on an average in 2017-2019 as compared to 202 in 2007-2009, and also with fewer products – 2,894 on an average in 2017-19 as compared to 3,167 a decade ago.

Drawing comparisons with more developed trading countries, Varela said that “For a given product Pakistan exports, it only reaches about 10 percent of the possible destinations, while China reaches 85 percent and Germany reaches 69 percent”.

However, he admitted that the trend in Pakistan is positive and that this penetration is on the rise. From a diversified destination rate of 7.9 percent in 2009, Pakistani products have now reached an average of 10 percent destinations.

“Some sectors do well in reaching many markets with their products. Not surprisingly, Textiles and Apparel out of Pakistan reach 182 markets, most of their products reach 40+ markets. But foodstuffs, perhaps a rising star, has space to grow. Only 10 products reach 40+ markets,” Varela remarked,

On the flip side, there are certain challenges that cannot be ignored, particularly the discontinuation of some successful export products. In Pakistan, 437 products were exported in 2009, but they have been discontinued today. “And while churning is good, only 146 new products were introduced between 2009 and now,” highlighted Varela. As a sum total, this means that there is less innovation in Pakistan as is evident from its impact on the net exports.

Similarly, on the quality front, Pakistan has been facing difficulties in measuring and designating quality levels for its exported products. Despite these challenges, the relative price fetched by Pakistani exporters in global markets is better as compared to competitors. Rice is a good example of this but textiles prices may discount this factor.

The lower price spectrum of textile products can also be explained by how Pakistan competes on the lower end segment when it comes to the global textile market.

ALSO READ

Govt Finally Pays Attention as Pakistan’s Textile Hub Revives After 30 Years

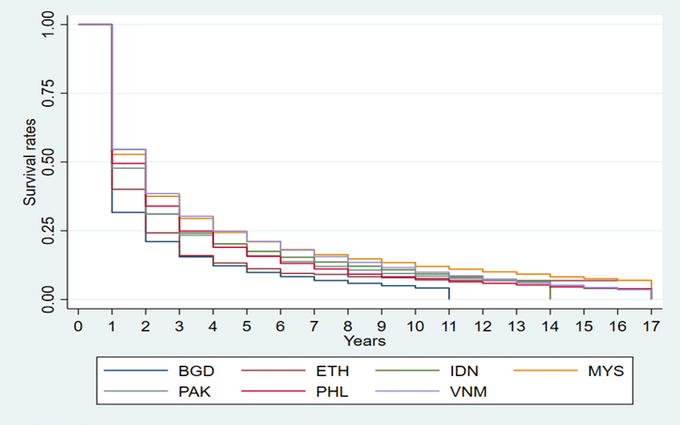

Varela also pointed out that while a projected export flows out of Pakistan “that starts today shows a 48 percent probability of surviving past one year, exporting is a risky business… Part of the survival story is that there’s low entry and exit into exporting compared with others”.

To conclude the factors highlighted by Gonzalo Varela, it may be said that despite a contraction in the range of products and the number of destinations for Pakistan’s export products, there are still certain sectors that can benefit from some extra attention. The impetus to improve the quantity, quality, and competitiveness of export products should be a joint effort from the public and private sectors.

Previous evaluations of the export sector problems in Pakistan have repeatedly highlighted the need for less protection of domestic industries and more incentives for free trade. Now, with the exchange rate of the Pakistani rupee stabilizing against the American dollar, perhaps it is time to revisit the idea of ‘prohibitive’ tariffs and extra protections.

The post Pakistan’s Export Sector Not Without Challenges, but Opportunities Abound appeared first on .