Pakistan is lagging behind the regional countries in terms of penetration of mobile subscribers and mobile internet subscribers, according to a study published in an annual report of the State Bank of Pakistan.

The digital divide in the economy is still significant with issues of coverage as well as usage gaps.

Around 54 percent of the population has access to mobile broadband coverage, but they do not subscribe to internet bundles (usage gap). Similarly, around 20 percent of the population does not have access to mobile internet services (coverage gap).

ALSO READ

The Need for Addressing the Internet Woes of Balochistan

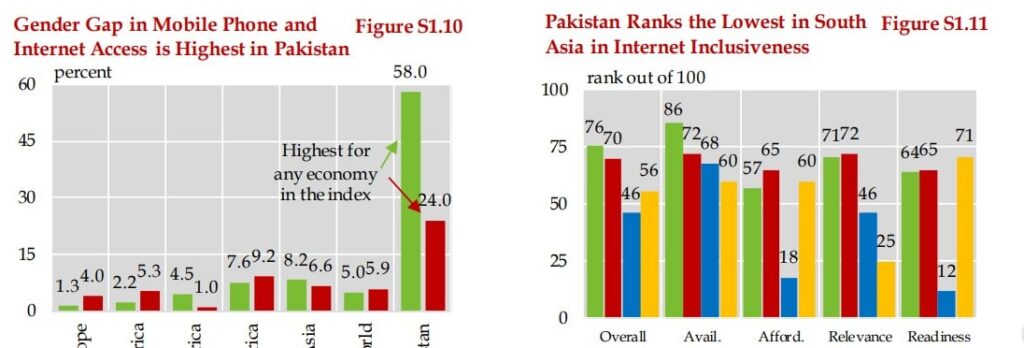

There is also a significant variation in mobile phone ownership between urban and rural areas. The demand and supply factors also come into play. Given the low-income level in the country, high taxes on cell phones curtails the ability of people from owning a smartphone.

Meanwhile, an inadequate level of literacy, especially digital literacy, is also behind the low smartphone and internet usage levels in the country. So much so, that about a quarter of the population does not know how to use the internet, while around half does not deem it as a useful or interesting activity which further hinders progress, according to SBP’s report quoting Economist Intelligence Unit.

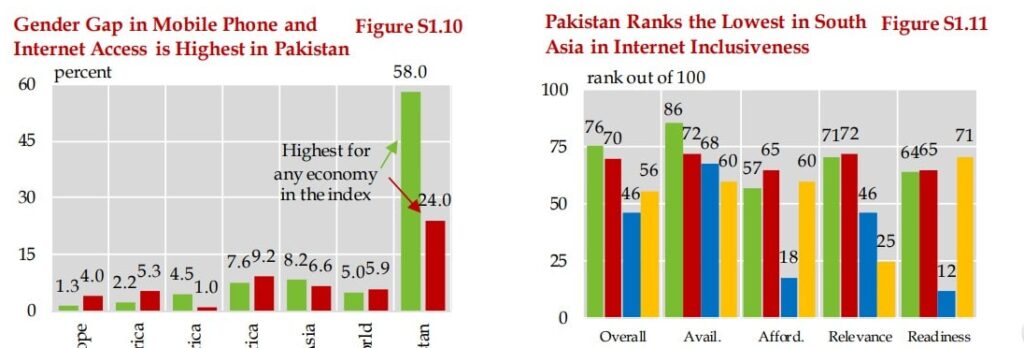

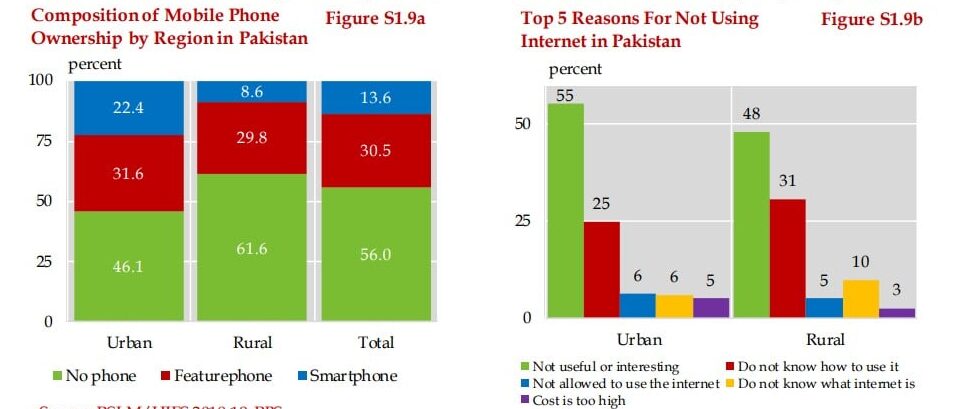

(EIU) Internet Inclusiveness Index 2020, the global average gender gap (the difference between the proportion of the male and female population) in terms of mobile phone access and internet access is 26.5 percent and 19.8 percent, respectively. In Pakistan, these gaps rise to 58.0 percent and 24.0 percent, respectively – both are the highest out of the 100 economies in the index.

Pakistan Lags Behind Regional Economies

Furthermore, it is vital to understand that the digitization of services is not a development that can happen in isolation; the overall human capital and economic development ecosystem needs to be geared towards addressing the inefficiencies from the grass-roots level.

ALSO READ

81 Pakistanis Get Featured in Stanford’s List of World’s Top Scientists

The adult literacy rate is currently only 59.1 percent in the country, and support for digital literacy is inadequate. Similarly, low-income levels mean that affording a smartphone and running a data network is challenging. In such a landscape, the following proposals may help address the shortcomings.

SBP’s Recommendations

First and foremost, Pakistan has to substantially upgrade its digital infrastructure. This is because in the nearing era of 5G and the internet of things, capacity and bandwidth would be crucial. Currently, the level of assigned bandwidth in the country is amongst the lowest in the region.

The telecom authority needs to ensure timely investments and proper planning. Rural areas and tier-2 cities need to be prioritized to bring them at par with the urban localities to ensure equal accessibility.

Likewise, over-1 GHz bands need to be expanded to ensure big data analytics and transmission, and smoothen network exchanges in commercial areas in the near future.

Secondly, government authorities need to educate the population about the benefits of using digital services. National Financial Literacy Program and the Digital Skills Strategy are already in implementation phases, and positive results have been achieved so far as well.

However, going forward, it would be necessary to put digital literacy at the forefront of the country’s entire education system. The curriculum needs to incorporate material to equip students with the rapidly evolving needs of the job market. The skillset needed to excel in a number of jobs in the future will be profoundly different from what was required before. To this end, the content must be aligned with the needs of the private sector, with an eye towards both domestic and global trends.

Third, government authorities need to incentivize marketplaces and shopping outlets to offer mobile wallet payments, which would help increase the use of e-commerce and financial services in general.

Fourth, the federal and provincial governments must incentivize consumers, merchants, and other businesses to pay or receive their payments digitally.

Finally, digital financial services would not pick up on their own. For that, three things are important. First is the overall orientation of the economy towards digitization. If the various sectors of the economy are digitized, the resultant ease and efficiency in the whole ecosystem would automatically increase the attraction of using digital financial services. Second, digitized services must be well-integrated. Here, interoperability must be focused upon and incentivized. For example, the current mobile wallet infrastructure allows interoperability among all service providers via 1-Link. However, the players are not fully utilizing this facility, mainly to retain their existing market shares.

The third factor is to provide incentives to the market players to get them to be more cooperative with each other and be open to the whole ecosystem. It needs to be realized that, in the long term, the provision of an integrated channel would increase the overall pie of the digital users, which would also lead to an increase in the share of users of all service provider.

The post Pakistan Lags Behind Regional Countries in Mobile Internet Penetration appeared first on .