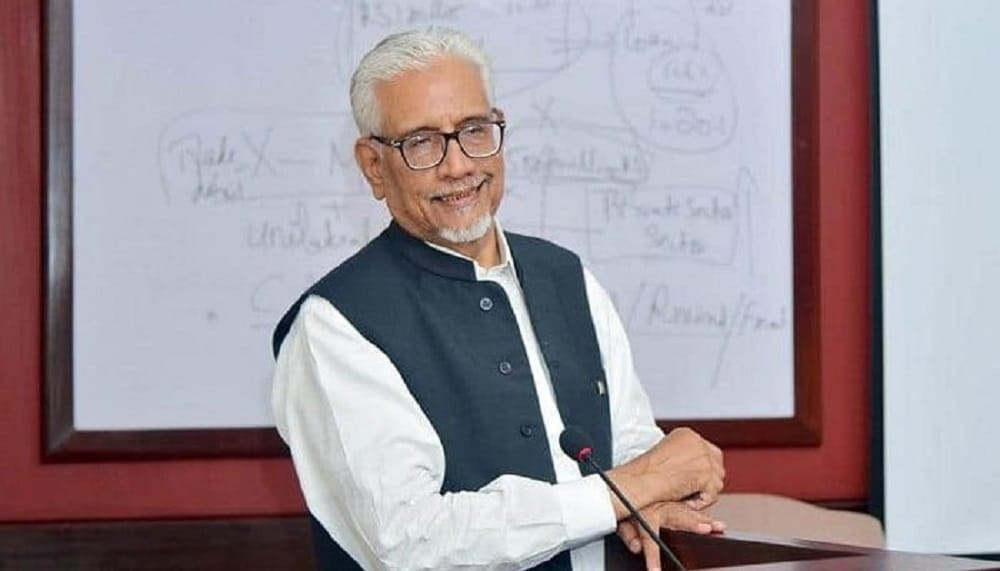

Special Assistant to the Prime Minister (Minister of State) on Finance and Revenue, Dr. Waqar Masood, held a special meeting to review the progress on the issuance of notices for broadening the tax base and recovery of taxes from the high net worth individuals.

Sources told Propakistani that this is the first internal meeting of the Federal Board of Revenue (FBR) after the Eid Holidays. The meeting was chaired by Dr. Waqar Masood and attended by FBR Member Inland Revenue operations and other officials of the Board dealing with the enforcement issues.

The meeting took the input of the field formations and decided to intensify efforts for expanding the tax net in the remaining period of 2020-21.

As of 1 May 2021, income tax returns for the tax year 2020 have reached 2.9 million compared to 2.6 million in the tax year 2019, showing an increase of 12 percent. The tax deposited with returns was Rs. 50.6 billion compared to only Rs. 33.1 billion in the corresponding period of the last year, showing an increase of 53 percent.

The meeting was informed that at present, FBR’s complete focus is on broadening the tax base and controlling tax evasion under tax administration reforms.

The FBR has asked its IT Wing and officials employing technology and maintaining a database to check from the withholding tax record that whether withholding tax has been deducted from these one million persons having no taxable income. There are almost 0.24 to 0.26 million persons who are getting Rs. 14 billion to Rs. 20 billion worth withholding tax deducted.

With the help of technology, the FBR has been able to collect all this information of withholding tax to broaden the tax base. The FBR is taking measures to ensure that the complete relationship between the taxpayer and the tax collector should be technology-based.

Similarly, 6.4 million persons are having NTNs, who are legally bound to file their annual income tax returns under the law. There are 3.7 million persons who are registered but are not filing their income tax returns. It is their legal obligation to file their income tax returns.

The FBR has its database and data of other federal and provincial government departments engaged in public dealings such as land records and registration of vehicles. All these departments have now started sharing data on the purchase and sale of immovable properties and registration of new cars with the FBR.

The data of those doing business dealing with the government departments is also available with the FBR. The utility data of electricity and gas is very large, and we are utilizing all such data, said the FBR officials.

The FBR has taken withholding tax data of three years, including the FBR data and data available from these organizations and government departments.

The FBR has found that 8.9 million people whose withholding tax has been deducted during the last three years. “On average, we have received returns of around 1.5 million persons only during the last three years. If we minus 1.5 from 8.5, we are left with 7.4 million people,” the officials said.

It is mandatory for these 7.4 million people (whose record of withholding is available) to also file their income tax returns with the FBR, but they are not filing their returns.

Every citizen can access his information on “tax-ray” and file returns having taxable income. The FBR has reached the level of information where we can enforce the filing of returns by these 7.4 million individuals based on the available record of withholding.

However, the FBR cannot simultaneously approach all 7.4 million, but they have prioritized persons and will go for big cases in the first phase.

The FBR has received data of 100 million people from telcos. The FBR will also use the data of telecommunication companies for expanding the tax net. These are mobile phone customers having CNICs. They have shared data of those where withholding tax has been deducted.R

The post SAPM Holds Special Meeting to Recover Taxes from High Net Worth Individuals appeared first on .