Adviser to the Prime Minister on Finance and Revenue, Dr. Abdul Hafeez Shaikh, addressed the second segment of the plenary session of the World Economic Forum (WEF) on Country Strategy Dialogue (CSD) through video link today.

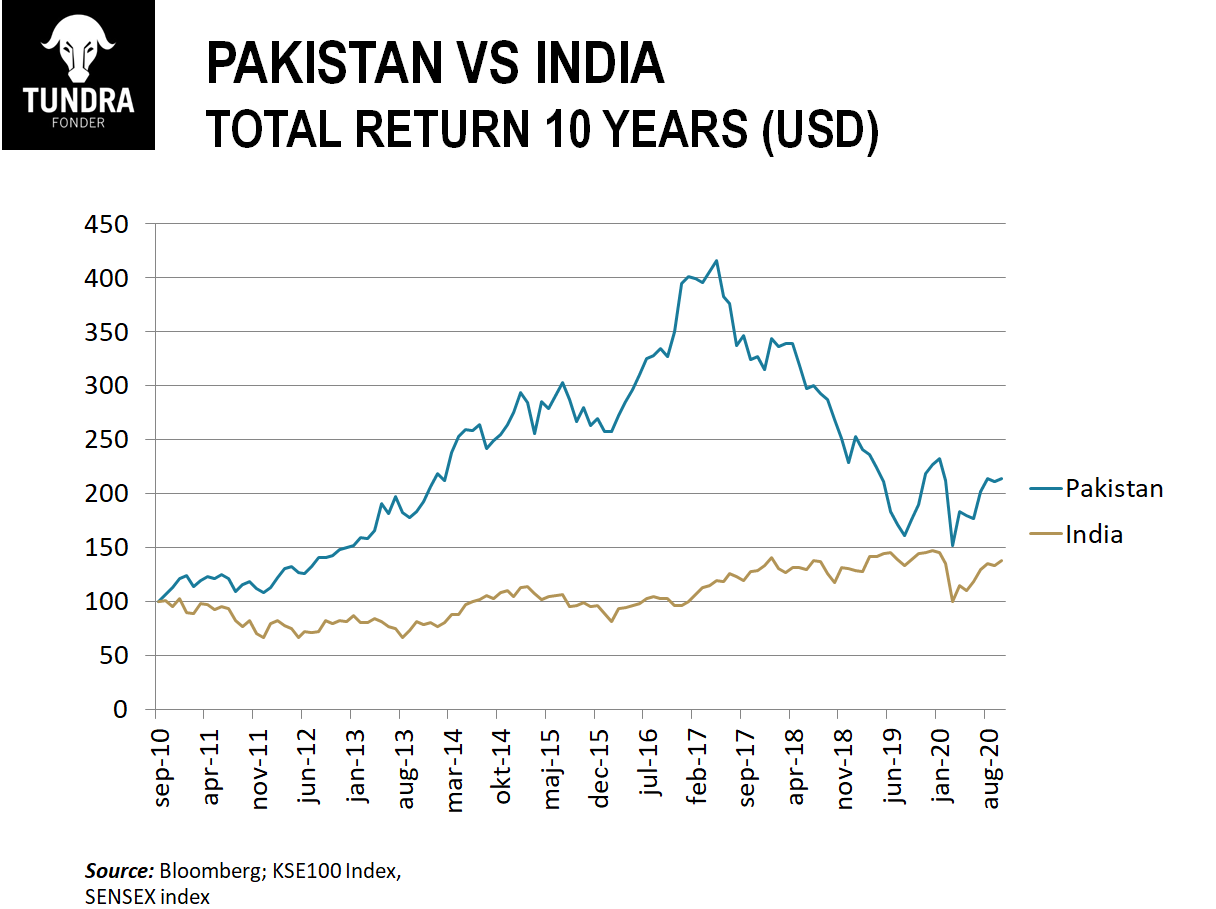

During his virtual address, Adviser Finance briefed the forum that the current Government inherited a very precarious economic situation in 2018, and therefore, had to introduce strict financial discipline to curtail excessive Government expenditure, increase revenue collection, introduce a market-driven exchange rate, remove large tax exemptions, and discourage imports.

As a consequence, Pakistan witnessed a remarkable improvement in fiscal and current account deficits. Similarly, Pakistan had a primary balance surplus, which is unprecedented.

ALSO READ

25 November Will Be Celebrated as Pakistan Strategy Day Across the World: WEF

All fundamental economic indicators reflected significant improvement before COVID-19. During COVID-19, the Government of Pakistan introduced “Smart Lockdown” to balance the imperative and to contain the spread of the disease with the need to keep the economy functional.

The Smart Lockdown allowed businesses to re-open or continue operations on a limited scale to lessen the adverse economic impact and support the vulnerable segment of the society. To provide relief to vulnerable groups especially, daily wage earners, the Government of Pakistan gave cash payments to 15 million families under the “Ehsaas Emergency Cash Program”.

Adviser Finance also outlined that amid COVID-19, Government has taken several initiatives to facilitate agriculture and construction sectors to accelerate economic recovery. A relief package for Small Medium Enterprises (SMEs) shielded against insolvency and joblessness.

The recent data complements the strengthening and expansion of the economy in ’’recovery’’ mode. Despite COVID-19, Pakistan has registered an upward trend in foreign remittances and Foreign Direct Investment (FDI), which is a clear reflection of confidence in Pakistan’s economy.

ALSO READ

Pakistan’s Consumer Confidence Improves in Third Quarter of 2020

Adviser Finance reiterated that the Government firmly supports the private sector as an engine of growth and believes in building institutional capacity for sustainable and inclusive economic growth. “We followed a liberal foreign investment regime and introduced measures to promote ease of doing business in the country,” he stated.

He remarked that the current leadership welcomes foreign investors and believes in transparency, accountability, and openness. Our agenda is to empower people with a key focus on human resource development, Adviser Finance concluded.

Continue Reading