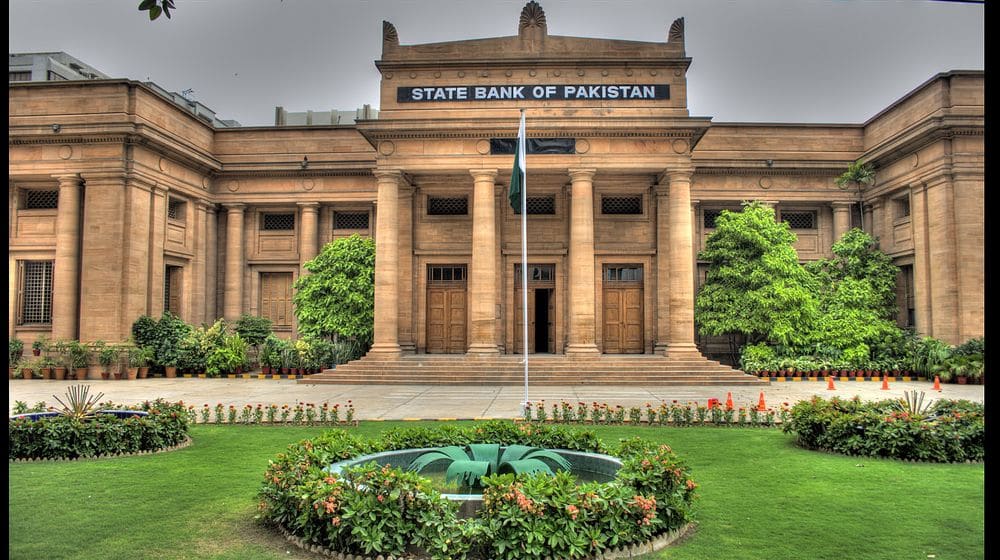

Seemingly on the insistence of commercial banks, the State Bank of Pakistan (SBP) has allowed banks and various service providers to charge a minimal fee from the Interbank Funds Transfer amounting above Rs. 25,000.

The central bank directed banks to provide free-of-cost digital fund transfer services to individual customers up to a minimum aggregate sending limit of Rs. 25,000 per month per account/wallet.

However, banks may choose to set this aggregate limit at a higher amount as well. This would allow individual customers to make as many free fund transfer transactions, remaining within their aggregate monthly limit of free transfers.

For transactions above the aggregate limit of Rs. 25,000 per account in a month, banks may charge individual customers a transaction fee of no more than 0.1 percent of the transaction amount or Rs. 200, whichever is lower.

This will enable service providers to recover part of the costs they incur on providing inter-bank fund transfer service and build sustainable and innovative business models.

ALSO READ

You Can Now Pay for Your Honda Cars With HBL Mobile App

Nevertheless, the new instructions encourage banks to provide free-of-cost digital fund transfer services to their customers to promote the adoption of digital payments in the country.

SBP has also advised banks that all digital fund transfer transactions between different accounts within the same bank (intra-bank fund transfers) shall remain free. Further, incoming interbank fund transfer transactions shall also remain free.

SBP has further directed banks to ensure proper disclosure of charged and free IBFT amounts along with applicable fees to their customers by sending regular notifications through SMS, apps, and email.

After every digital transaction, banks are required to send free of charge SMS to their customers on their registered mobile numbers, intimating them about the transaction amount and the charges being recovered.

To provide seamless digital banking services to the public, SBP has further advised banks to remove any limits on the number of fund transfer transactions on their customer accounts/wallets unless there are genuine concerns related to AML/CFT or frauds.

To cope with the extraordinary situation of lockdowns amid the COVID-19 pandemic in 2020, SBP advised banks and other service providers in March 2020 to offer free-of-cost Inter Bank Fund Transfer (IBFT) services to all their customers regardless of the size of the transaction.

ALSO READ

FBR Issues Clarification Over Taxes on Pensions and Salaries

The objective was to facilitate bank customers to meet their banking services needs through online services during the pandemic and avoid in-person interaction to curb the spread of COVID-19. This step resulted in an overwhelming response by customers, with internet and mobile banking transactions more than doubling in Q2FY21 over the last year.

SBP appreciates the support of all service providers for this initiative by allowing free-of-cost interbank fund transfer services to the public without recovering their operational cost and incurring substantial revenue losses.

It is encouraging that the COVID-19 situation has improved significantly, and despite the fluctuating number of cases, the overall conditions now allow relaxations in mobility restrictions while following proper SOPs.

In this backdrop, SBP reviewed the current IBFT pricing mechanism and has made some changes to ensure that the free-of-charge IBFT services are provided by banks and other financial institutions on a sustainable basis.

The post Banks Can Now Charge Fee on Interbank Funds Transfers Above Rs. 25,000 appeared first on .