Founder and Chief Investment Officer at Tundra Fonder, Mattias Martinsson, in a series of tweets on Wednesday, explained his preference for investing in Pakistan’s stock market instead of India’s bourse.

In the tweets, he suggested investing in Pakistan instead of India, citing three strong reasons.

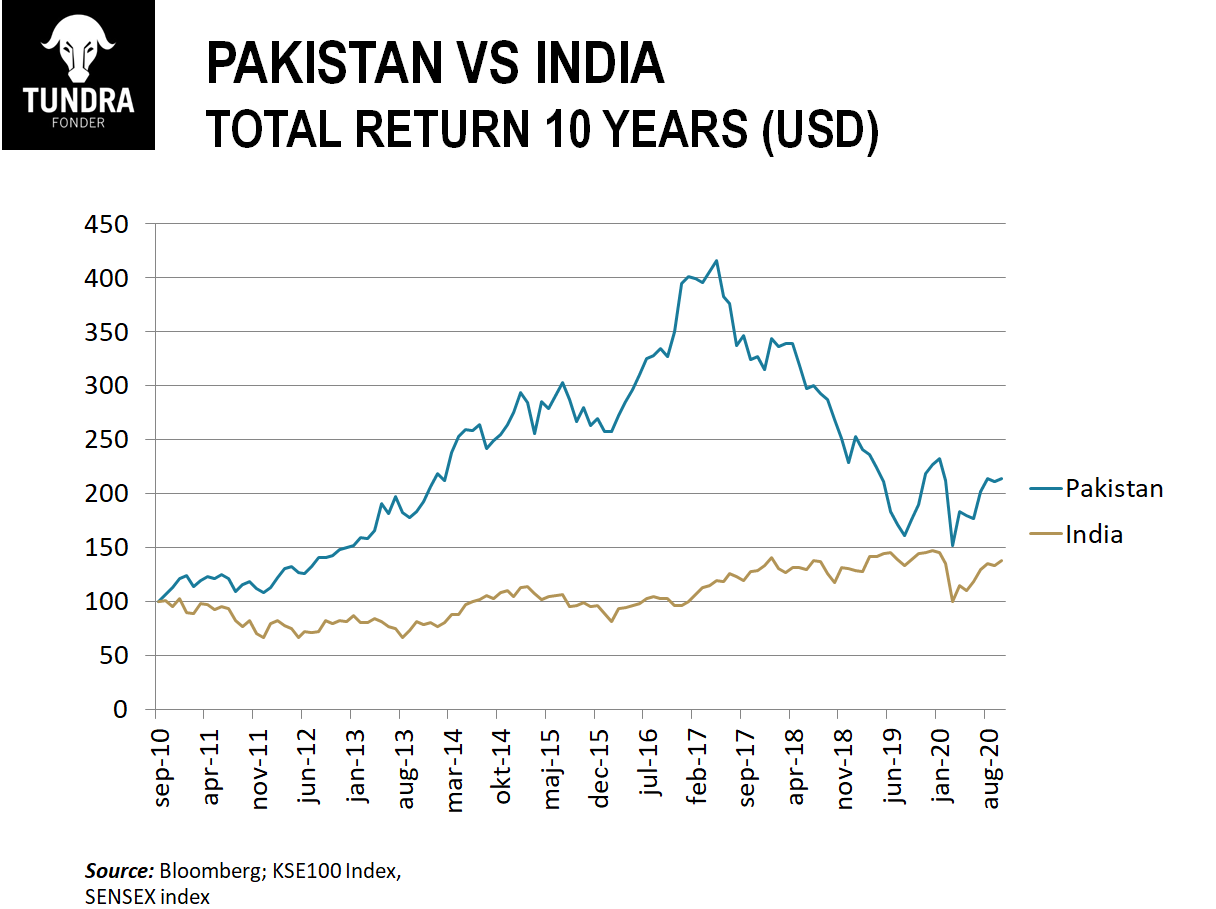

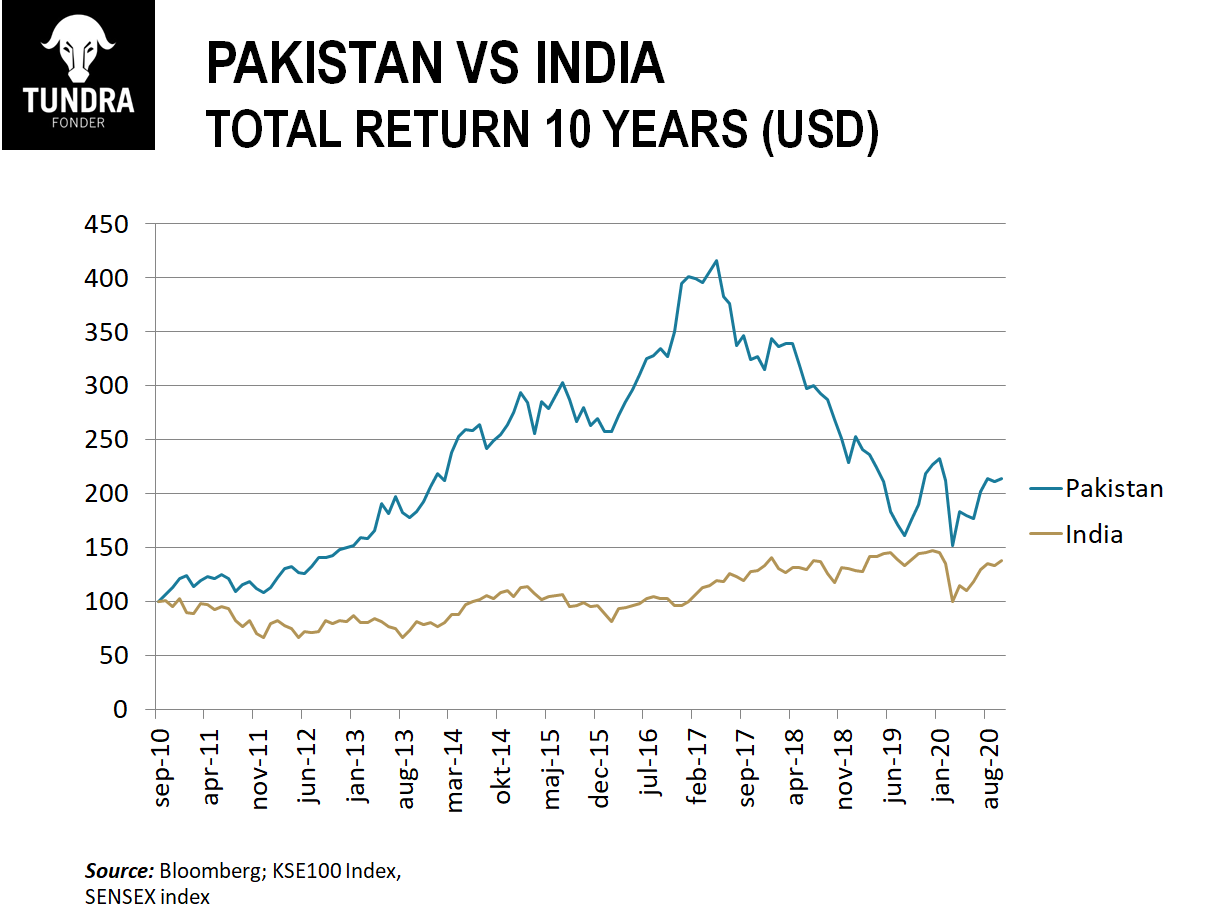

First, over the past decade, Pakistan’s stock market has performed better than India’s, in terms of USD. Pakistan’s benchmark index, the KSE-100, has outperformed India’s Sensex Index in terms of total returns (USD), as shown in this graph based on Bloomberg data.

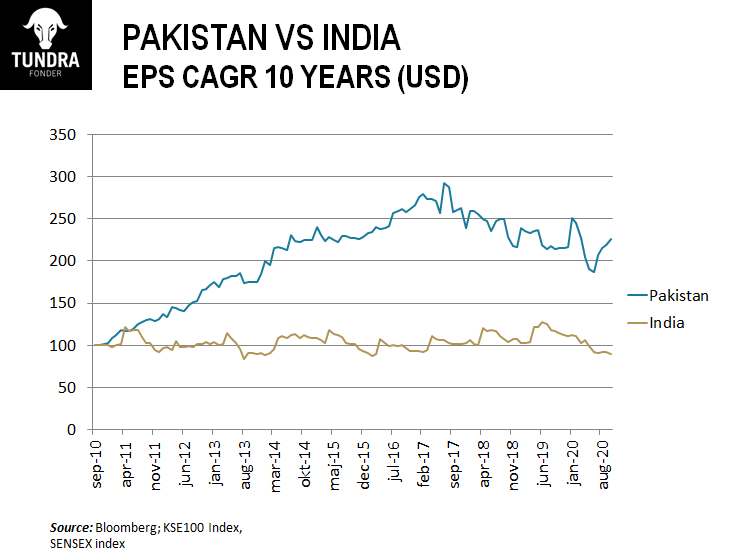

Secondly, the earnings per share (EPS) growth of the KSE index has also been higher in terms of USD when compared to Sensex’s earnings. This means that not only the index shows better and higher activity, but the listed companies are also better performers.

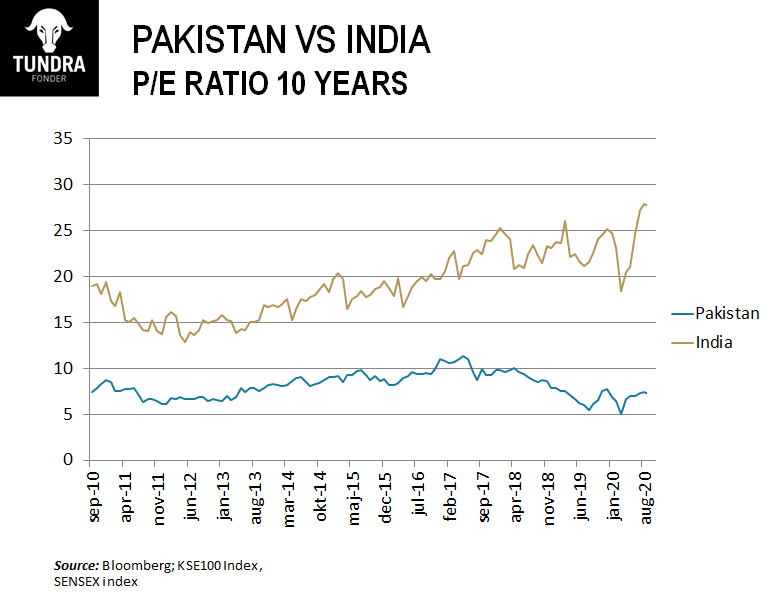

The third reason that the investment expert and pioneer in frontier and emerging markets cited in favor of investing in the Pakistani stock market was that the expectations are low. In financial terms, this translates into a lower price-earnings ratio (P/E) of the KSE-100 index as compared to the Sensex P/E ratio over the past ten years. P/E ratio is a tool universally used to determine the stock valuation. A high P/E ratio means that the stock is overvalued, which means that it costs more than its actual value based on the predicted returns.

Apart from these data-driven arguments, a look into the recent performance of the Pakistan Stock Exchange (PSX) will also show better investment opportunities. The KSE-100 has consistently performed well and has emerged as the best performer in Asia between February and March this year. It is also the fourth best-performing stock market in the world, showing strong resilience against the COVID-19, which caused stock indices to plummet worldwide.