Pakistan Water and Power Development Authority (WAPDA) has hired banks to arrange investor calls for the issuance of its first US Dollar-denominated green bonds.

According to news reports, JPMorgan, Deutsche Bank, Standard Chartered, and Habib Bank have been hired to arrange the planned benchmark issuance of seven-year or 10-year bonds subject to market conditions, the investors’ note showed.

Earlier this year, the government announced plans to issue a green bond worth $500 million. WAPDA is looking to sell this 10-year note to raise funds in this round and pave way for more environmentally-friendly debt over the next two years, said Chairman WAPDA, Muzammil Hussain, at the time of the announcement.

According to a media outlet, WAPDA listed the Indus Bond — a green Eurobond (GEB) — on the London Stock Exchange (LSE) to raise $500 million to finance mega hydropower projects.

The government is investing in renewable energy to ramp up its economic stimulus in the wake of the pandemic. Pakistan aims to tap soaring investor demand globally for green debt and opt for other environment-focused financial channels, such as debt swap agreements.

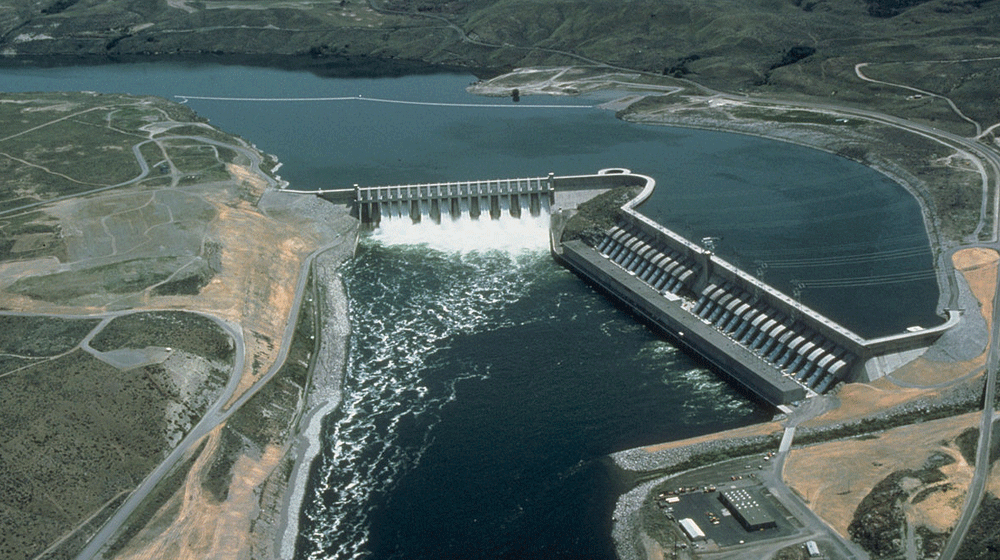

Pakistan is planning to increase renewable and hydroelectric generation to 60 percent of total electricity by 2030. The funds from the proposed dollar bond will be used to fund the Diamer Basha and Mohmand dams in the nation, according to Muzammil Hussain.

The debt raised through the Indus Bond will be used for the construction of mega hydropower projects, including Diamer Basha and Mohmand dams in the next five years.

These bonds will be issued for the tenor of seven or ten years, and bids are expected from the UK, USA, and Singapore

The post WAPDA Hires Banks for its First Issuance of Green Bonds appeared first on .