Pakistani companies raised Rs. 35.4 billion via initial public offerings (IPOs) and Rights from the stock market (PSX) in 2020. This is approximately the same as compared to Rs. 35.7 billion raised in 2019, said a report released by the brokerage house Topline Securities on Wednesday.

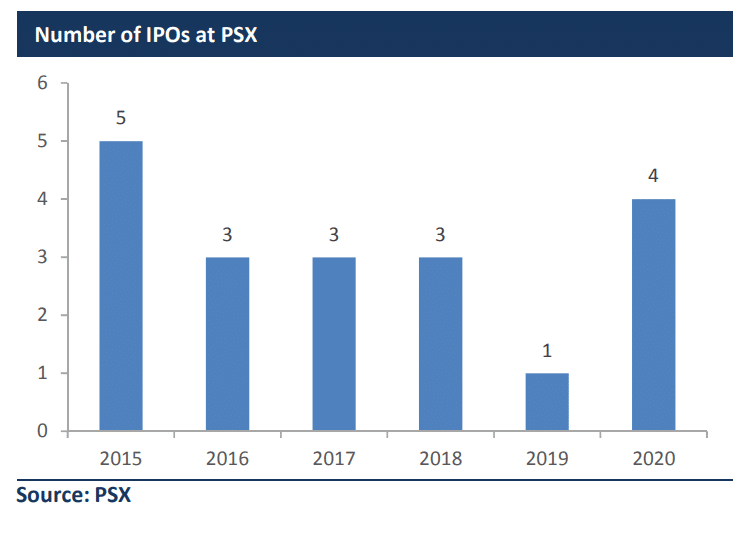

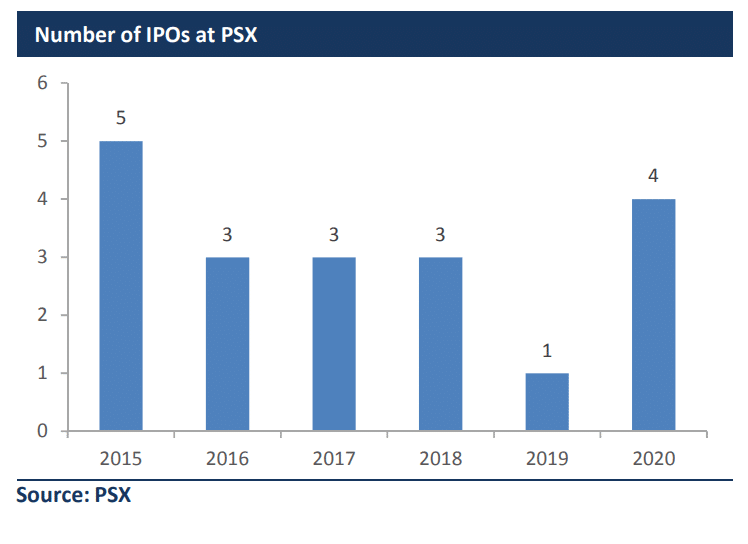

According to the report, four IPOs and fourteen Right Issues took place at the Pakistan Stock Exchange (PSX) in 2020. The bourse witnessed four IPOs (including are preference share listing) during the year in spite of the COVID-19 outbreak, where the cumulative amount raised clocked in at Rs. 8.4 billion. The number of equity IPOs this year, is the highest in the last five years.

In 2019, PSX witnessed just one IPO of Rs. 5 billion.

Amongst these from listing to date, The Organic Meat (TOMCL) has generated the highest total return of 50 percent, followed by Agha Steel’s (AGHA) return of 15 percent. TPL Trakker (TPLT) has lost 17 percent of its value since its listing.

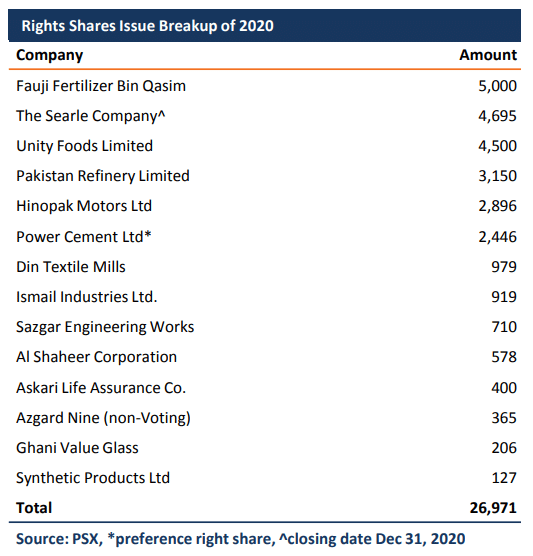

On the Rights Issues, in 2020, 14 companies raised Rs. 27 billion through Right Shares with Fauji Fertilizer Bin Qasim (FFBL) fetching the highest amount of Rs. 5 billion, followed by Searle Pakistan (SEARL) rights of Rs. 4.7 billion, and Unity Foods (UNITY) closely trailing behind with rights of Rs 4.5 billion.

As compared to this, in 2019, 17 companies had raised Rs. 30 billion through Right Shares wherein Hascol Petroleum (HASCOL) took the highest amount of Rs. 8 billion followed by Hub Power’s (HUBC) issue of Rs. 7 billion and Maple Leaf Cement’s (MLCF) issue of Rs. 6 billion.

Regarding the expectations for the calendar year 2021, the report said that with an improving outlook on the stock market, many equity IPOs are in the pipeline. Seven companies, like Shell Petroleum (SHEL), have already announced Right Shares amounting to Rs. 16 billion.

The post Pakistani Companies Raised Rs. 35.4 Billion Through IPOs and Right Issues in 2020 appeared first on .